More common sense than knowledge is the key to any sound investment…

Article by Vivion O’Kelly

The money is there, safe in the bank, perhaps from the sale of a second home, a business, savings, an inheritance or a big lottery win (as if!!!), and the question arises: what to do with it? As problems go, it is hardly painful, but it does require the serious thought of a sound mind. Getting it wrong could indeed be very painful.

Putting aside bitcoins, hurricane options, Virgin Mary cheese sandwiches and other such interesting enterprises, your choice comes down to property, or stocks and shares. But just remember, there are no absolutes in any of this. Comparing the total returns of the SPDR S&P 500 (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) since the turn of the present century, we can see that both property and stocks suffered almost equally as a result of the Great Recession and the Covid 19 crisis. But on a more positive note, according to the most recent statistics from Spain’s Central Bank, the expected return on the residential real estate market in this country is now 5.6 percent, based on gross rental yield of 3.71 percent and capital gain estimated at 1.9 percent.

We’ve taken a look at a number of articles written by various experts in both fields, some of them relating directly to investment for ex-pats in Spain. The consensus of opinion is that, given the economic conditions at this time in this place, along with the assumption that most investors in the expat socio-economic group value security over quick and potentially higher but risky return, one should lean towards the more tangible of the two, which is, of course, property investment.

It all comes down to how much money you have to invest (or how much of it you can afford to lose), how much time and effort you wish to put into your venture, how much you know about each option and how much you value peace of mind.

Basically, property is a tangible investment to hedge against inflation, while a stock investment is liquid and easy to manage and diversify. The first requires much work and an immediate big spend, and the second can only be done successfully with special skills, while not requiring large amounts of money to be spent at one time. Both, in fact, require more wisdom than any relevant skills or knowledge, given the ready availability of professional advice in both areas, although at added cost.

The do-it-yourself option tends to work better in real estate investment, and most of us have already ventured into the territory in purchasing our own homes, or even second homes. Reputable real estate companies on the Costa del Sol, as all over Spain, are usually in a position to offer good professional investment advice, which means you are seldom entirely on your own. They set out the options available and the expected returns, and you make the decision on what to buy. One way or another, you can be fairly certain that your investment will appreciate in the long run, especially with regard to real estate investment, and the days of buy-now-or-miss-the-opportunity-of-a-lifetime are long gone in today’s more sophisticated property market.

On the other hand, a new property can cost you a lot of money over and above its purchase price. Taxes, maintenance, insurance, rogue tenants, sudden drops in property values in particular areas or even plain ignorance can hit you hard. You didn’t know that they used to mine copper in this area a century ago, and those cracks in the walls…

But this is where the laws of probability come into play: you may have purchased a faultily constructed villa on a piece of marshy land that didn’t have full planning permission and turned out to be legally owned by a long-dead Mexican who left it to a dog’s home in Peru. Or you may have made a wonderful investment in a company whose founder and owner turns out to be a Nigerian prince currently searching for a good criminal lawyer in Lagos. Chances are, both of these scenarios are as real as a big lottery win.

And what about GameStop, you might ask…

The fact is that most of us hear about these sudden and spectacular gains long after the opportunity to invest wisely has passed – and keep in mind that a few minutes can be a long time in this game. But if you happen to be an assiduous amateur with your nose to the screen, beware of our natural tendency to rely more on gut feeling than clear thinking. It may seem to be a very good idea right now to buy silver, considering the likelihood of it continuing to rise in value as a consequence (or extension) of the GameStop story. But you don’t know when it will begin to fall again, and therein lies the rub.

It may be useful to think about the Martingale fallacy. Even regular casino goers will assure you that if you have enough money to do so, you just keep doubling your bets as you lose on red or black, and simple arithmetic proves that when you eventually win, you’ll win really big. Their arithmetic may be simple, but the wrong blend of hope and conviction prevents them from taking out a calculator and doing it.

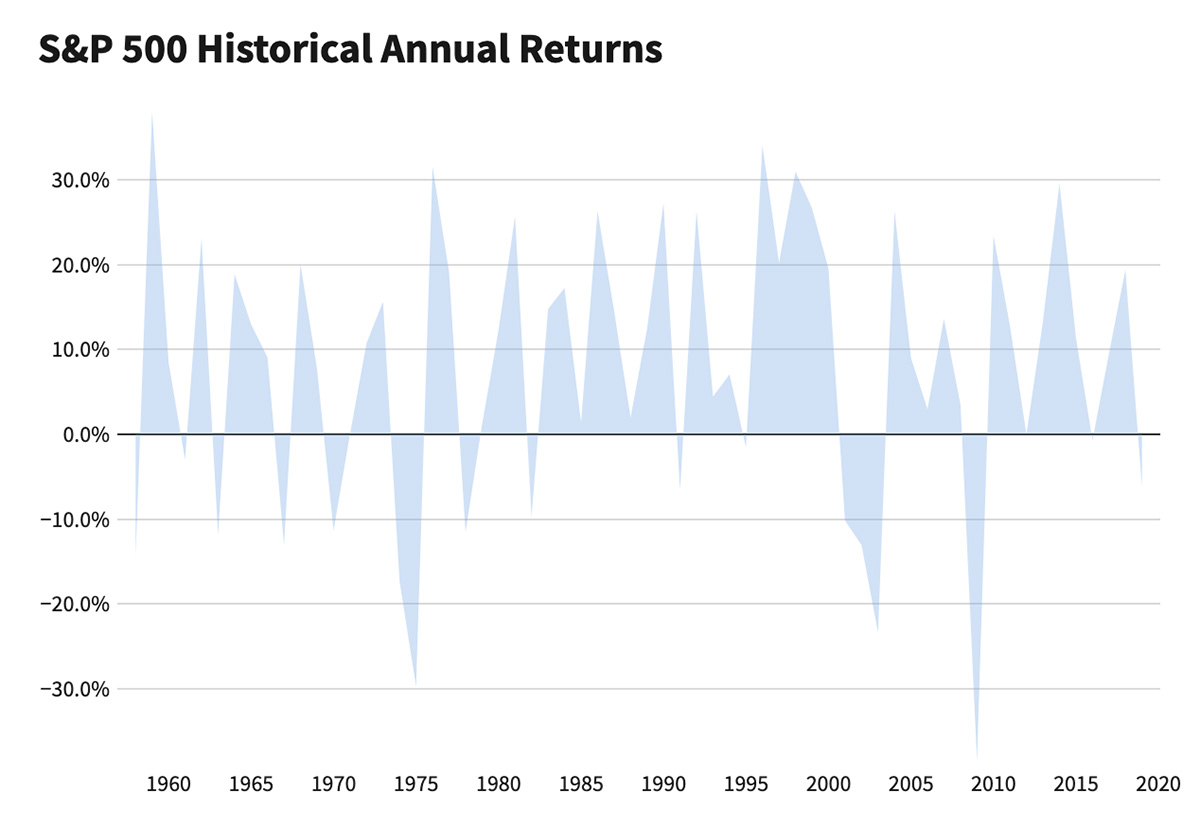

So let’s stick to sounder stocks and real estate for the moment, and we notice that much of the advice given on the question of which to invest in comes in the shape of bullet points that are too obvious to be of any value to a person of average intelligence, or simply overlap, as if the entire issue could be reduced to a list of easily digested pros and cons. We know that playing the stock market on your own is risky, and we know that most stocks will not turn out to be in the same league as Apple and Microsoft. We know that it is much easier to unload stocks and shares than a large pile of bricks and mortar. Stock market volatility may be exciting, and returns may be beyond our wildest dreams, but a house is a house is a house, and if there happens to be some stagnation in the property market at any given time, history has shown us that prices generally keep rising, however slowly they might do so.

Our advice then is to look closely in both directions, identify which suits you and the amount of money you have to spend, talk to a reputable investment advisor and gain sufficient knowledge to allow you to make your own mind up in the end, just like buying a new car. To sum up, an investment in real estate is for a person who can afford the initial outlay, who shies away from risk, who is not entirely comfortable with assets he cannot see, who is in no particular need of a quick return and who is prepared to do the work necessary to maximize income on a property.

And a stock investment is for a person who values liquidity, who might wish to borrow against investment, who can at least pretend interest in a company’s performance and results, who likes doing his sums and who has the rare ability to listen to the experts and act accordingly.

All fairly basic stuff, but it sums up most of what may take hours of difficult reading on investment websites. It does not, however, take into account any special circumstances that might apply to you alone, and all our circumstances are different. This is where good financial consultants are worth their fees. They will tell you about the diverse range of real estate options available (what do you know about publicly traded REITs, for example?), about tax deductions that could colour your decision, about the differences between stocks, bonds, mutual fund, EFTs and money market funds, about how capital gains could hit you harder than most, about all the smaller financial details hidden in the nooks and crannies of an investment portfolio. We just never know what we don’t know about anything.

We finish by asking that you remember this: the stock market often operates with the logic of a narcissistic donkey on crack, while sometimes, the property market may not be very different from a roller coaster ride in a fairground. But who do you know got rich by leaving their money in a savings account?